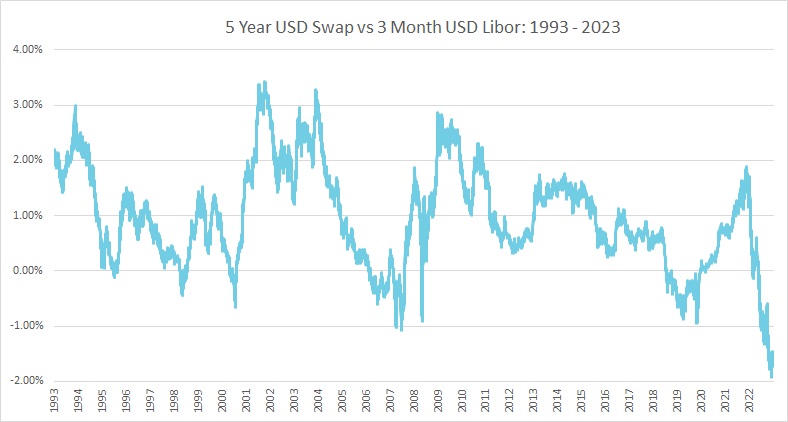

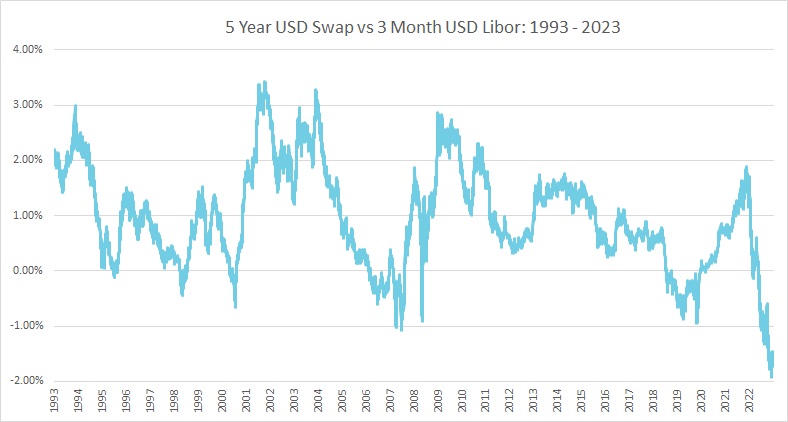

Some borrowers may feel they have “missed the boat” to hedge interest rates after the significant rise in rates in the second half of 2022. The decline in term rates in response to US regional bank concerns, however, has created a potentially attractive entry point.

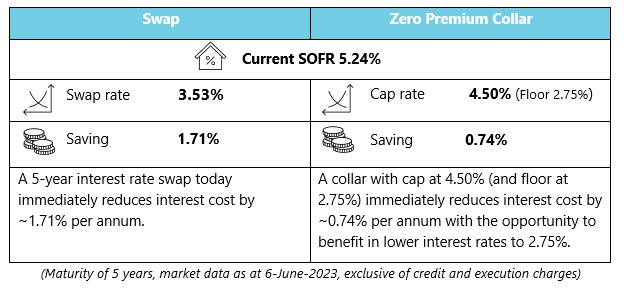

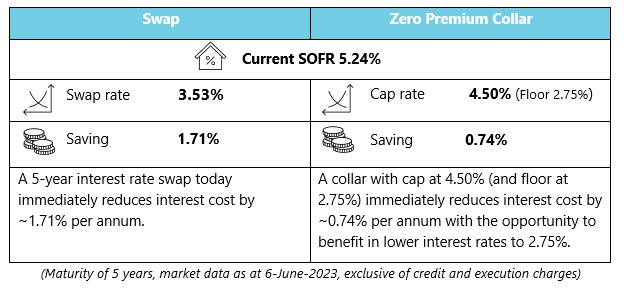

PMC notes that the current USD yield curve inversion, for example, is at a 30-year historical high which creates an opportunity to use interest rate swaps or collars to immediately generate 75-135bps of interest expense savings (750k – $1.35mm annually per $100mm debt principal).

The chart below shows the extent of the current USD yield curve inversion with other major currencies having varying inversions (for example, EUR is inverted by 0.55%).

Here we illustrate two approaches that we have recently been advising USD borrowers on to hedge cost effectively.

These are just two examples of how a borrower could take advantage of the current rate curve inversion.

Please get in touch if you would like to discuss further.